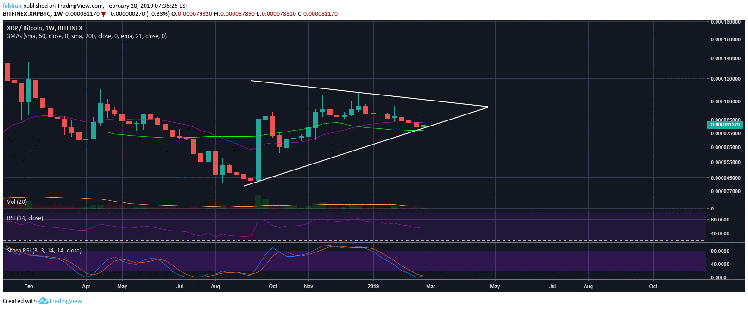

Ripple (XRP) is on the verge of a major breakout that could see the price rise or fall hard in the days ahead. The reason behind this uncertainty is that while XRP/BTC remains bullish, the rest of the market does not show enough signs for a sustained bullish momentum. In other words, even if other cryptocurrencies succeed in breaking to the upside, they still risk a fall in the long term. Ripple (XRP) on the other hand shows a slightly different short to medium term outlook but there is no denying that it will eventually have to fall to find its true bottom same as the rest of the market. For now, the price could actually succeed in breaking out to the upside as indicated by the daily Stochastic RSI for XRP/BTC.

We may not be able to see that rally last for a week or so but it will most likely be a fake out that will end up doing the opposite of what it initially signals. This symmetrical triangle that we see on the chart for XRP/BTC can be argued to have been broken sideways many times before. So, that also remains a point of concern. While the price is holding strong above the 50 day moving average and the Stochastic RSI also signals a breakout to the upside, there is still a lot of reason for caution as the long term outlook suggests a break to the downside. Now, Ripple (XRP) differs from most other cryptocurrencies in the long term outlook as well. While cryptocurrencies like Ethereum (ETH) and Litecoin (LTC) have reached overbought conditions on the weekly timeframe, Ripple (XRP) is not there yet.

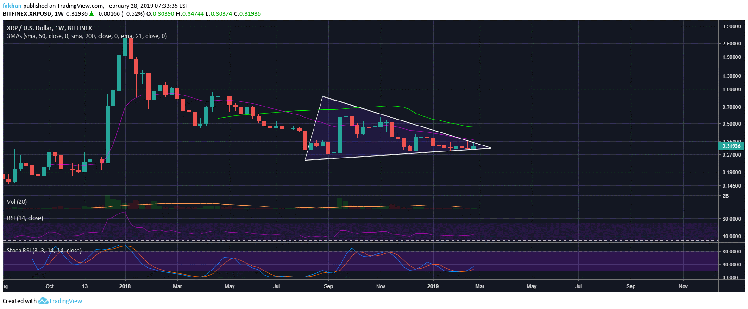

All of these developments mean that the breakout in XRP/USD is going to be a lot more significant and aggressive compared to most other cryptocurrencies. The long term outlook shown by the weekly chart for XRP/USD is a lot different than what we see in the case of other cryptocurrencies. This makes XRP/USD a good bet in mid to long term from a risk/reward standpoint. We do believe that it might be difficult for XRP/USD to break past the 50 day moving average at this stage. However, even if it succeeds in testing the 50 day MA from current levels, that would still be a big achievement and traders who accumulate at current levels might be able to make significant gains on their investment.

The weekly chart for XRP/USD shows that the trading volume has dried up and a move to either the upside or the downside has the potential of being quick, abrupt and short lived. So, traders should be better off not entering any margin positions whether long or short at this point. As for long term investors in Ripple (XRP), this would be the best time to start accumulating. Ripple (XRP) has also been listed on Coinbase in the past few days which we believe is going to have a game-changing effect long term once the market recovers.

Investment Disclaimer