Bitcoin

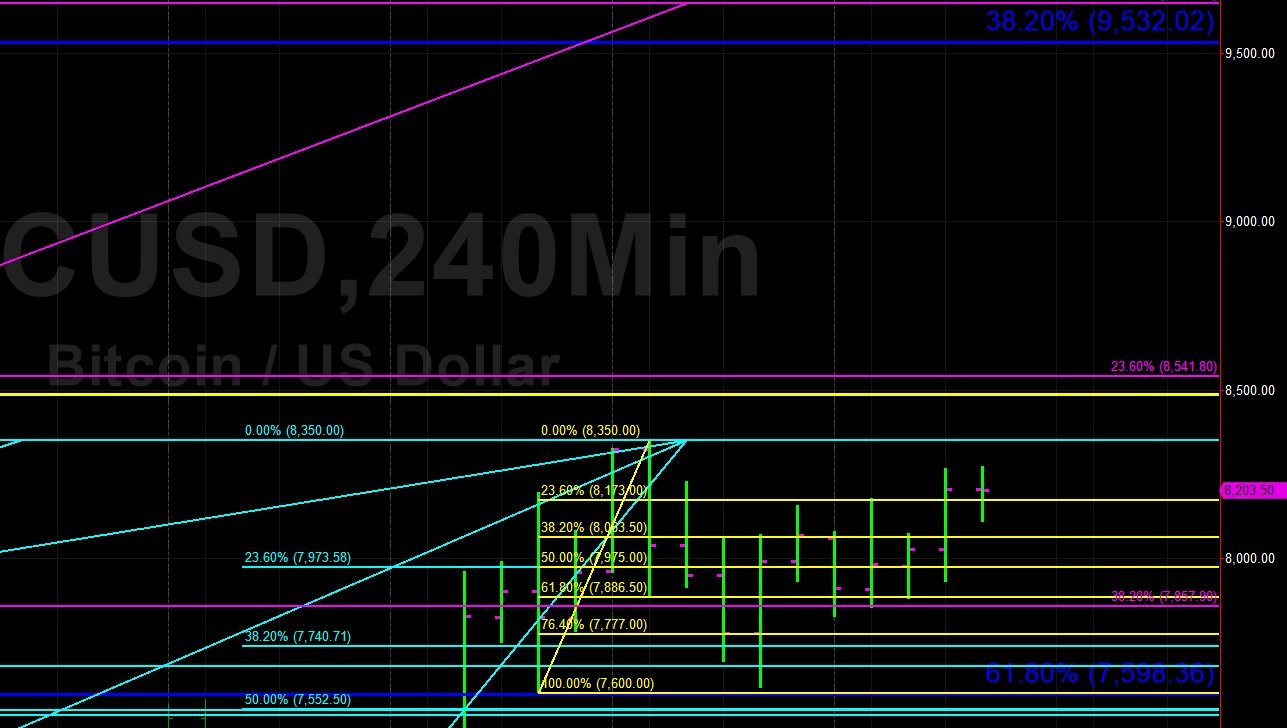

Bitcoin (BTC/USD) expanded recent gains during today’s Asian session, reaching the 8269.69 level after finding some Bids late during yesterday’s European session. The pair generally stayed Bid during yesterday’s North American session and Stops were elected above the 8172.02 area, representing the 76.4% retracement of the move from 8350.00 to 7621.27.

Traders continue to speculate whether BTC/USD will explode higher to fresh multi-month highs or whether it will instead consolidate recent gains. The pair continues to tightly hug its 50-bar MA (hourly). Above current price activity, the 9532.02 area is an upside target and it represents the 38.2% retracement of the key 19891.00 – 3128.89 range whereas the 9945.50 area is the 50% retracement of the all-time absolute range of BTC/USD. Likewise, the 9647.30 area is a key upside price extension objective that may represent some technical Resistance or exhaustion, and the 8541.80 area is a level associated with that upside price objective that may provide some technical Resistance as well.

Below current price activity, chartists are eyeing some levels such as 7343.17, representing the 61.8% retracement of the 9948.12 – 3128.89 range, followed by the 7223.25 area, representing the 76.4% retracement of the 8488.00 – 3128.89 range. Other notable levels below those areas include 7223.25/ 7117.82/ 7097.81.

Price activity is nearest the 50-bar MA (4-hourly) at 6924.84 and the 50-bar MA (Hourly) at 8018.95.

Technical Support is expected around 7561.81/ 7170.09/ 6853.50 with Stops expected below.

Technical Resistance is expected around 8488.00/ 9734.52/ 9948.12 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

Investment Disclaimer