Bitcoin

Bitcoin (BTC/USD) was pressured lower early in today’s Asian session as the pair fell to the 11,715 area after being capped around the 12,100 area during yesterday’s European session. BTC/USD moved steadily higher from the 10,300 level starting in yesterday’s Asian session, eventually triggering Stops above the 11,663.14 area that represents the 38.2% retracement of the 13,868.44 – 10,300.00 range. The pair came off after testing the 12,084.22 level, representing the 50% retracement of the same range.

Additional upside targets related to the same range include the 12,505.30 and 13,026.29 areas. Another important level is the 12,367.56 area, representing the 23.6% retracement of the move from 7508.77 – 13,868.44. Likewise, another technically-significant area is the 12,153.09 area, representing the 23.6% retracement of the 6600 – 13,868.44 range. Bitcoin bulls are looking to see if the pair can establish some constructive upside momentum by remaining supported at some key levels. The 9765.93 level represents the 38.2% retracement of the 3128.89 – 13,868.44 range. Traders also cite some Bids between the 10,468 – 10,508 levels.

Price activity is nearest the 50-bar MA (4-hourly) at 11,120.40 and the 50-bar MA (Hourly) at 11,891.99.

Technical Support is expected around 10,234.22/ 10,087.62/ 9765.93 with Stops expected below.

Technical Resistance is expected around 12,367.56/ 12,505.30/ 13,026.29 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

Ethereum

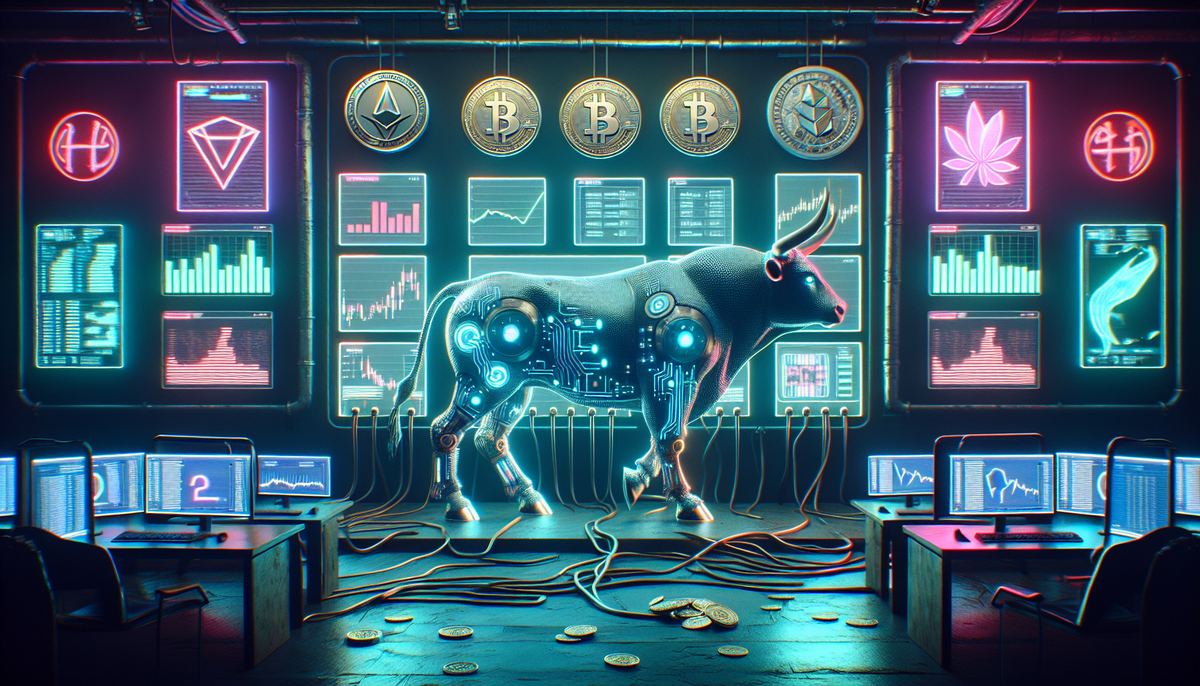

Ethereum (ETH/USD) gained some ground early in today’s Asian session as the pair tested Offers around the 307.43 area after trading as low as the 273.50 area during yesterday’s Asian session. Bids emerged above the 294.97 level, representing the 23.6% retracement of the 364.49 – 273.50 range, and then ETH/USD challenged the 308.26 area, representing the 38.2% retracement of the same range. Stops were also elected above the 305.63 area early in yesterday’s North American session, right around the 50-bar MA (4-hourly).

Upside ETH/USD targets related to the same range include 319.00/ 329.73/ 343.02. Stronger technical Resistance is likely around the 324.96 and 340.07 levels, important retracement areas related to the move higher from 261.00 to 366.48. Likewise, the 331.93 area represents the 23.6% retracement of the move from 226.56 to 364.48. ETH bulls are looking to see if the pair can continue to move higher and establish some constructive momentum above the 312 – 315 areas. Below current market activity, technical Support is possible around the 281 – 285 areas.

Price activity is nearest the 50-bar MA (4-hourly) at 307.15 and the 200-bar MA (Hourly) at 306.54.

Technical Support is expected around 272.56/ 249.90/ 226.56 with Stops expected below.

Technical Resistance is expected around 329.73/ 343.02/ 364.49 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

Investment Disclaimer