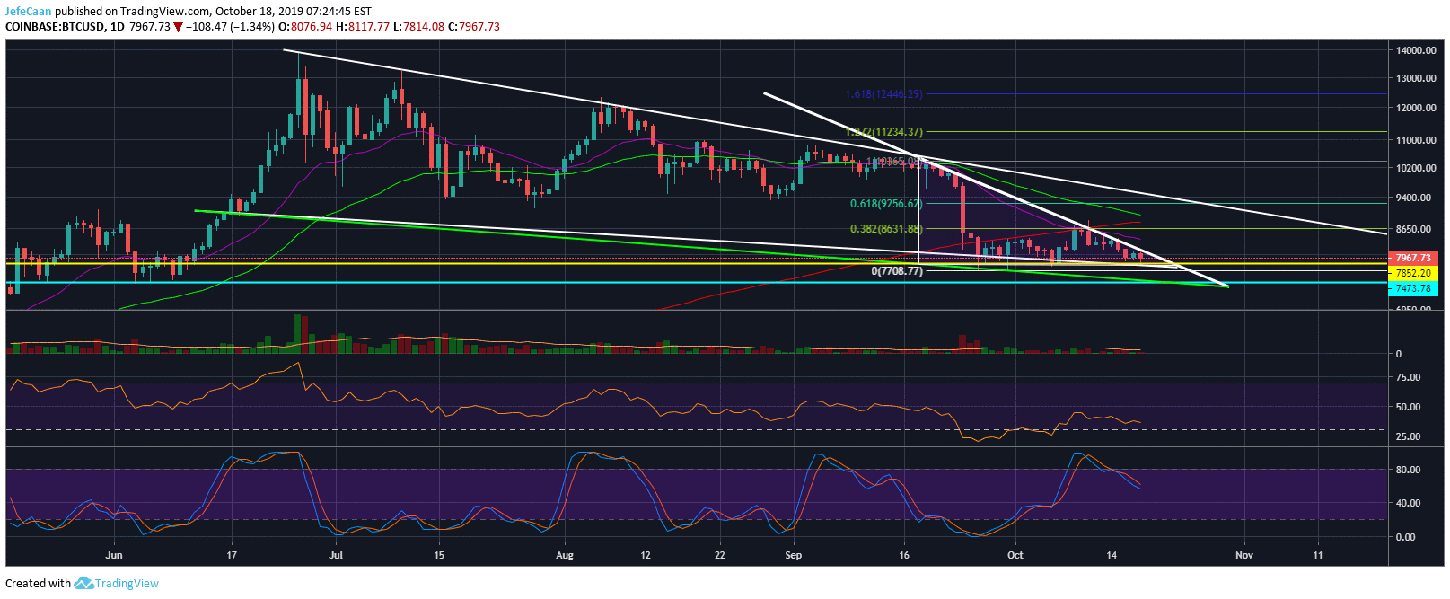

Bitcoin (BTC) has seen massive volatility recently and investors are confused as to its next direction. The bulls and bears are the most divided at this point with the bears expecting a decline down to $6,000 while the bulls expect the descending triangle on the daily chart for BTC/USD to be invalidated and for the price to rally past $8,000 to $9,256 and higher levels in the days ahead. Developments over the past few days have convinced me that what is happening at the moment is just scare tactics to discourage the bulls from getting onboard and encourage the bears to short the market just before a big move to the upside. That being said, I remain bearish on the market long term.

We could see temporary upside from current levels but that is by no means an indicator of real buying interest returning to the market. We can see on Crypto Twitter, Youtube and other forums that engagement is near the lowest and there is not much interest in cryptocurrencies. The price swings are more manipulated than ever and it is obvious that the regular trader has nothing much to do with it. It is just a group of big players playing games with retail traders and taking their money. To them, it does not matter whether they prey on the bulls or the bears. Their goal is to prey on both as much as possible. At every point in the market, you have to think about how they can do that. In this case, the perfect play would be to liquidate the bulls and get the bears more confident.

If Bitcoin (BTC) was supposed to decline towards $6,000 I think we would have seen that happen in a way that would have discouraged shorts from stacking up. However, so far that does not seem to be the case. Shorting this market seems way too easy. There is sideways movement followed by a major decline. This has encouraged the bears to keep on shorting, taking profits and then shorting again. They have gotten used to this to the point of being complacent and I think we are very close to seeing these market makers inflict more pain on the bears now.

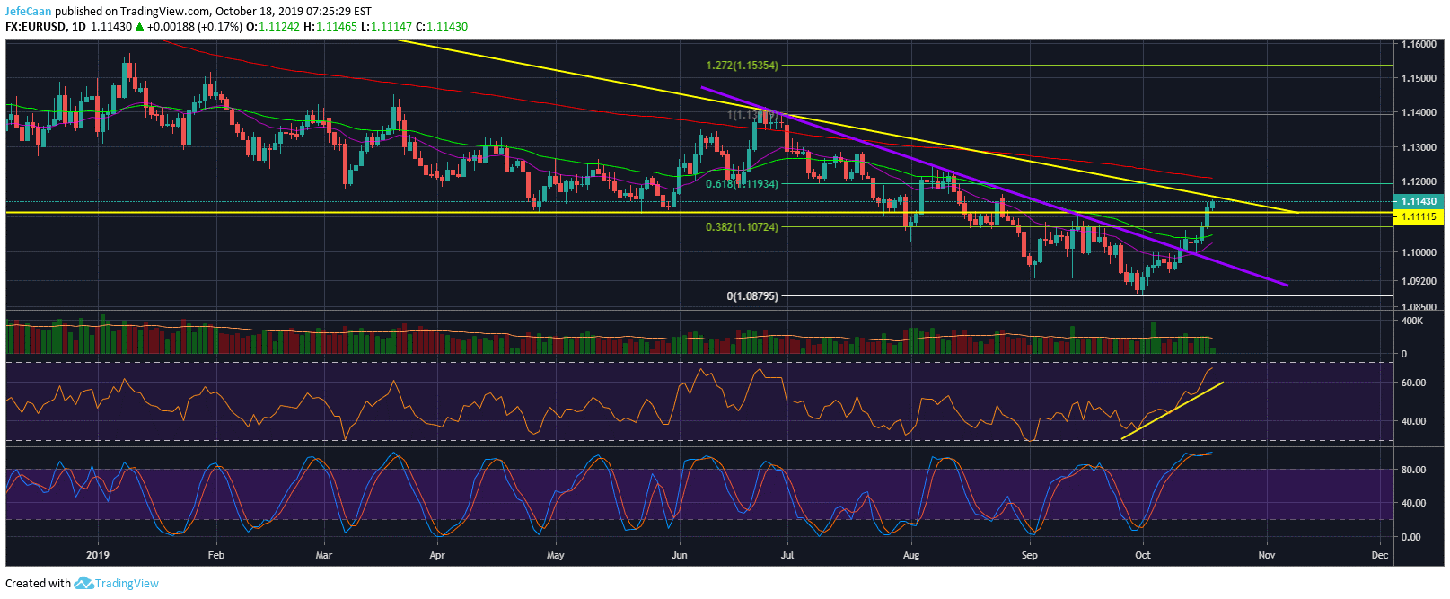

The daily chart for EUR/USD shows that we now have three daily candles above the 50 day EMA which is a very bullish development short term. This points to the strong probability of a rally towards the 200 day EMA. This is also why I think the recent panic in the Bitcoin (BTC) market is staged. The price of Bitcoin (BTC) should be rising and not falling in light of these developments. Lest we forget, the focus here is on a major bearish setup, one that might see BTC/USD decline by more than 70%. It thus makes a lot of sense that the market makers would want the bears to get more confident just before they inflict more pain on them to discourage them from shorting the market exactly before that massive 70% decline. This would also trap more bulls just before a devastating decline which would be the cherry on top of the cake.

Investment Disclaimer