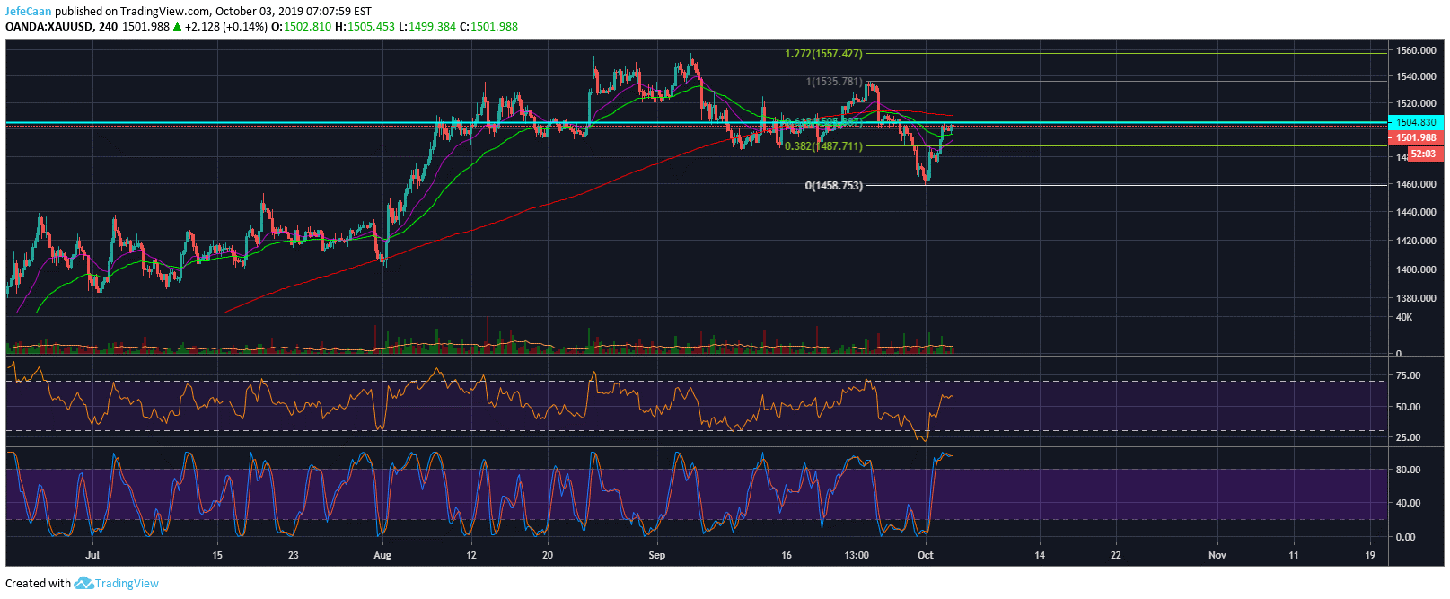

Gold has recently been an important leading indicator for Bitcoin (BTC). We have seen the price of Bitcoin (BTC) react to movements in Gold (XAU/USD). We do not know for sure how much of that correlation was real and how much was staged but we do know that a correlation existed which a lot of investors counted on to see where the price of Bitcoin (BTC) is going to head next. Now that Gold has run into a strong resistance at the 61.8% fib retracement level and is on the verge of a potential trend reversal, is it reasonable to say that Bitcoin (BTC) could do the same? Well, for most investors in the cryptocurrency space it is either Gold or the S&P 500 that they think Bitcoin (BTC) has a positive correlation with. However, at this point both are on the verge of a sharp decline.

The recent rally in Gold was as misleading as the rally in Bitcoin (BTC). It gave retail traders a false idea that Gold is somehow going to be the hottest investment for the next two years when it couldn’t be further from the truth. The supply and demand have made it very clear that this is not likely to be the case and that the recent rally in Gold was fueled by greed and desperation as investors had no other market to turn to. Gold has long been a safe haven asset and when there is trouble in almost every major market, it makes a lot of sense that investors would turn to Gold. However, changing global political landscape now points to there being a higher probability of investors being more interested in the US Dollar (USD) compared to Gold in the months ahead.

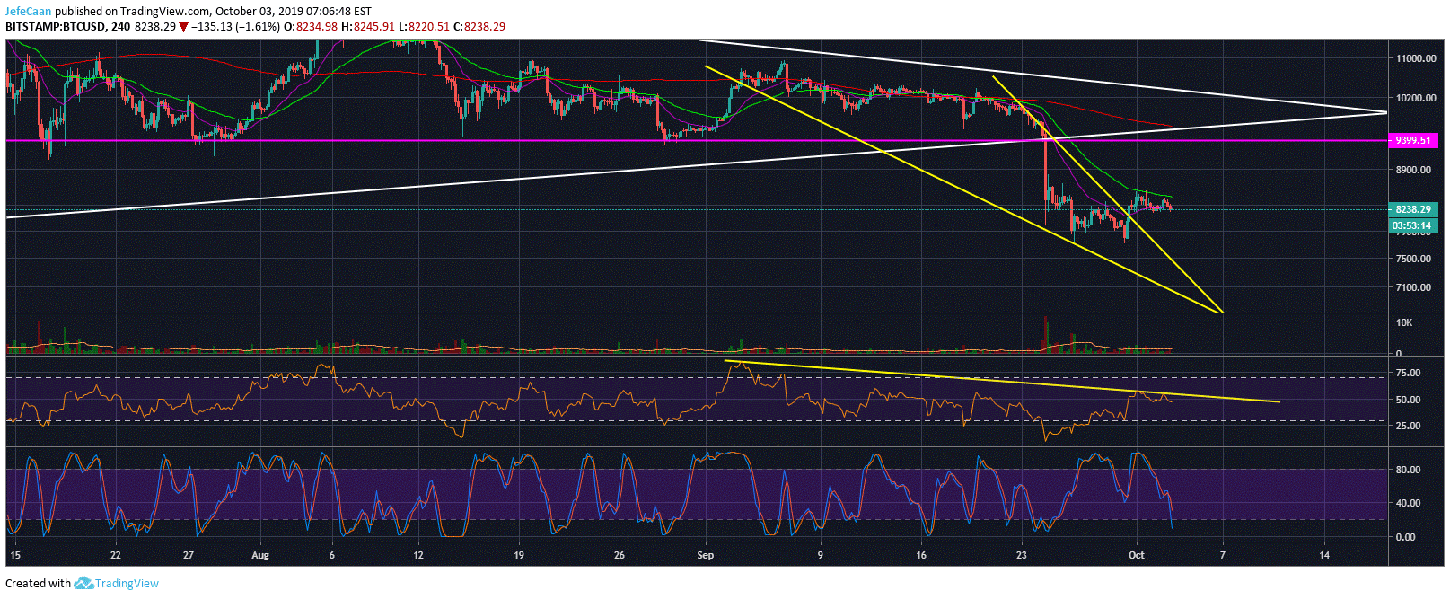

The 4H chart for BTC/USD shows what exactly the recent rally accomplished. All it did was unnerve some aggressive bears and form another top which has now increased the probability of the price declining towards the top of the previously broken falling wedge. Soon as we see a decisive break below the 21 EMA on the 4H time frame, we are likely to see a sharp move to the downside follow. It would not be surprising if the price actually ends up falling even lower than $7,000 during the next downtrend.

At this point, I see no reason at all why anyone would invest in Bitcoin (BTC) other than to think that it could be a safe haven asset during times of crises. It makes no sense to think that Bitcoin (BTC) or any other cryptocurrencies would hold their ground when the stock market starts to collapse. Despite all the narrative building around Bitcoin (BTC) being digital gold, we know that it is no safe haven asset by any standards. Big investors are not interested in whether Bitcoin (BTC) can be a safe haven asset or not. They are interested whether it is a safe haven asset at this point in time or not. The reality on ground is that it is not which is why it is one of the worst times to be investing in Bitcoin (BTC) in light of macroeconomic and political developments.

Investment Disclaimer