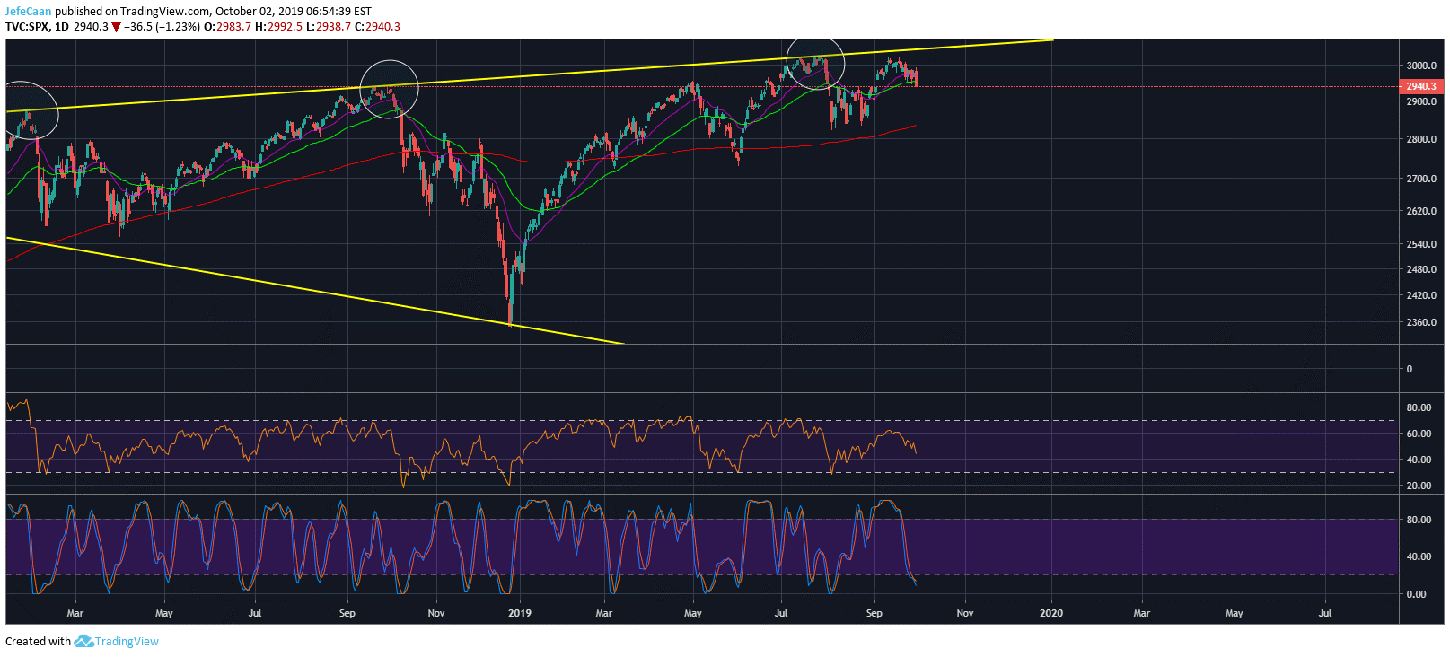

The S&P 500 (SPX) is on the verge of a major downtrend as the index closed the day below the 50 day EMA yesterday. This recent development on the S&P 500 (SPX) is quite alarming for investors on Wall Street but it is even more alarming for those on Crypto Street because Bitcoin (BTC) or any other cryptocurrency is a riskier investment than buying a stock that is backed by a business behind it. Some might argue saying Bitcoin (BTC) has intrinsic value and all that but that is only one piece of the pie. There are a lot other factors that come into play and in the case of Bitcoin (BTC) we have seen the price deviate way off its intrinsic value. It would be very unreasonable to assume that this could only happen in the positive direction.

We could see Bitcoin (BTC) fall well below what it costs to mine one Bitcoin (BTC) as we have seen in the past. The reason I bring this up is because every time the technicals point to a massive downtrend around the corner, some investors try to come up with reasons why Bitcoin (BTC) cannot fall that low. For some it is the cost of mining, for some it is Bitcoin (BTC) being digital gold and for some it is events like Bakkt. I think we have seen adequate proof of how such fundamental events are irrelevant and inconsequential against technicals. Many of the well respected and widely followed traders only follow the charts with little regard for fundamental events. The only reason you should stay informed of fundamental events is to ascertain what the average investor is thinking. Crypto Twitter is particularly useful for doing that.

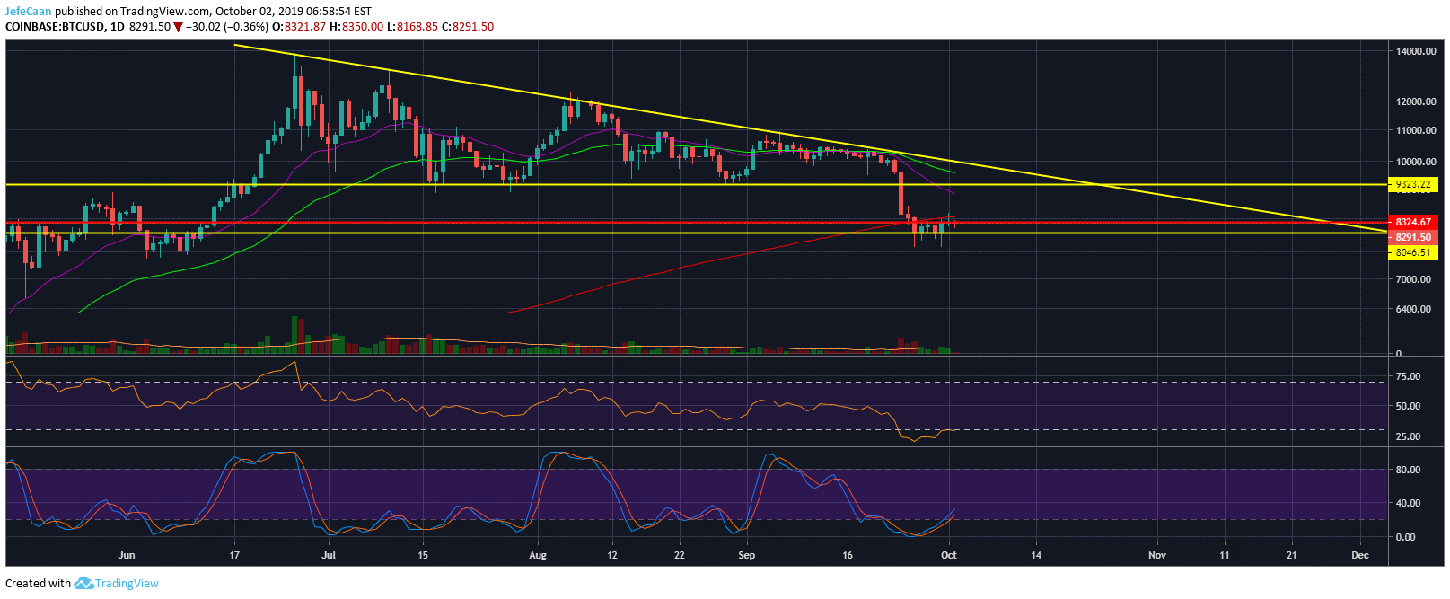

So, here is the situation that we have in front of us. The S&P 500 (SPX) has just closed below the 50 day EMA. Meanwhile, BTC/USD is struggling to break past the 200 day EMA after closing below it for the past one week. This tells us that Bitcoin (BTC) is at a very high risk of breaking below the descending triangle that it has now declined to. If that happens we are looking at serious downside from this point forward. In that case, I would not count on the price stopping around $7,100 or similar levels. I would see it declining well below that towards $6,000 or even lower before we see some relief.

It is thus very important not to enter trades hoping for a reversal but to recognize the bearish momentum and the direction that the price is trading in. If the price was meant to recover, it would have done so by now. The longer the price remains close to the bottom of the descending triangle, the higher the probability that it is eventually going to break below it and when that happens, you do not want to be holding Bitcoin (BTC) or worse other cryptocurrencies.

Investment Disclaimer