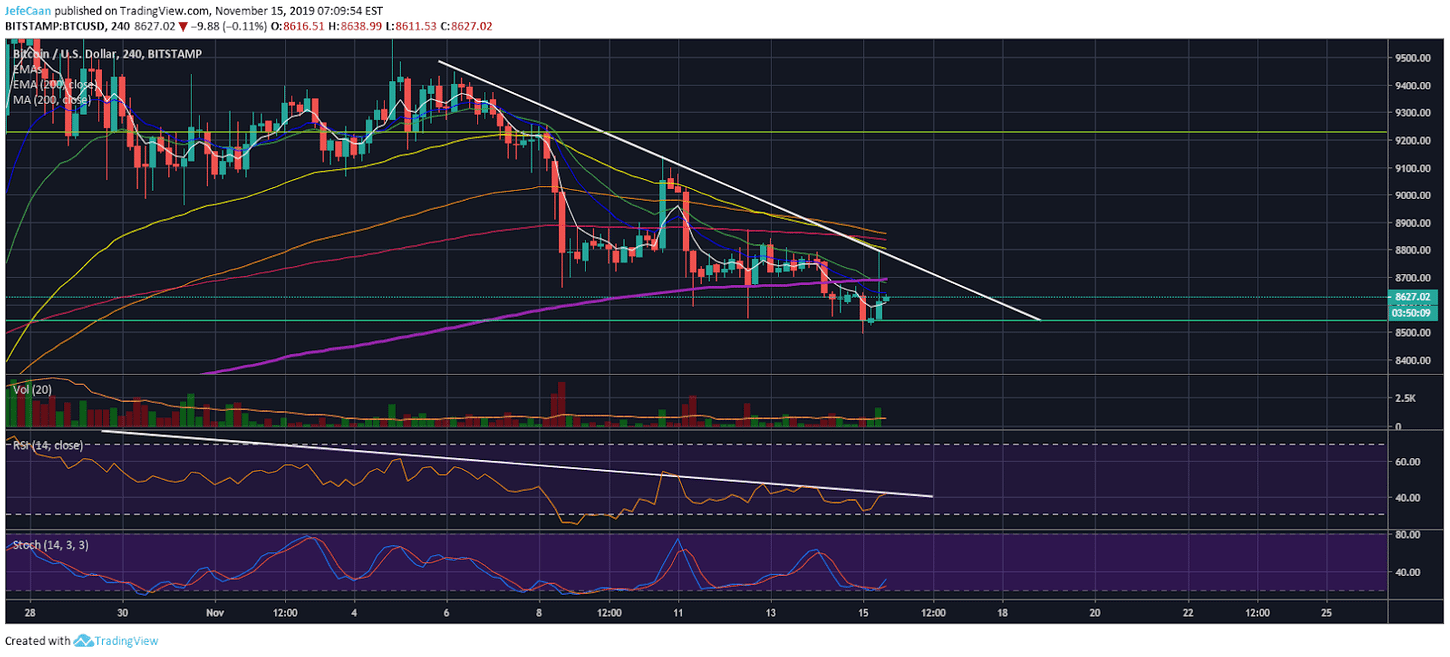

Bitcoin (BTC) is once again at a decision point and the bulls and the bears are both confused as to what that decision is going to be. We saw BTC/USD begin the day in red but it then made a big move to the upside which was similar to the manipulated moves we have seen recently. When the stakes are this high, such moves are to be expected. In the absence of real volume and trading interest in the market, most of the big players make their money playing such games. The recent move liquidated more than $40 million Bitcoin shorts in a matter of seconds. The price is back below the 200 MA on the 4H time frame which has rendered this whole manipulated move useless.

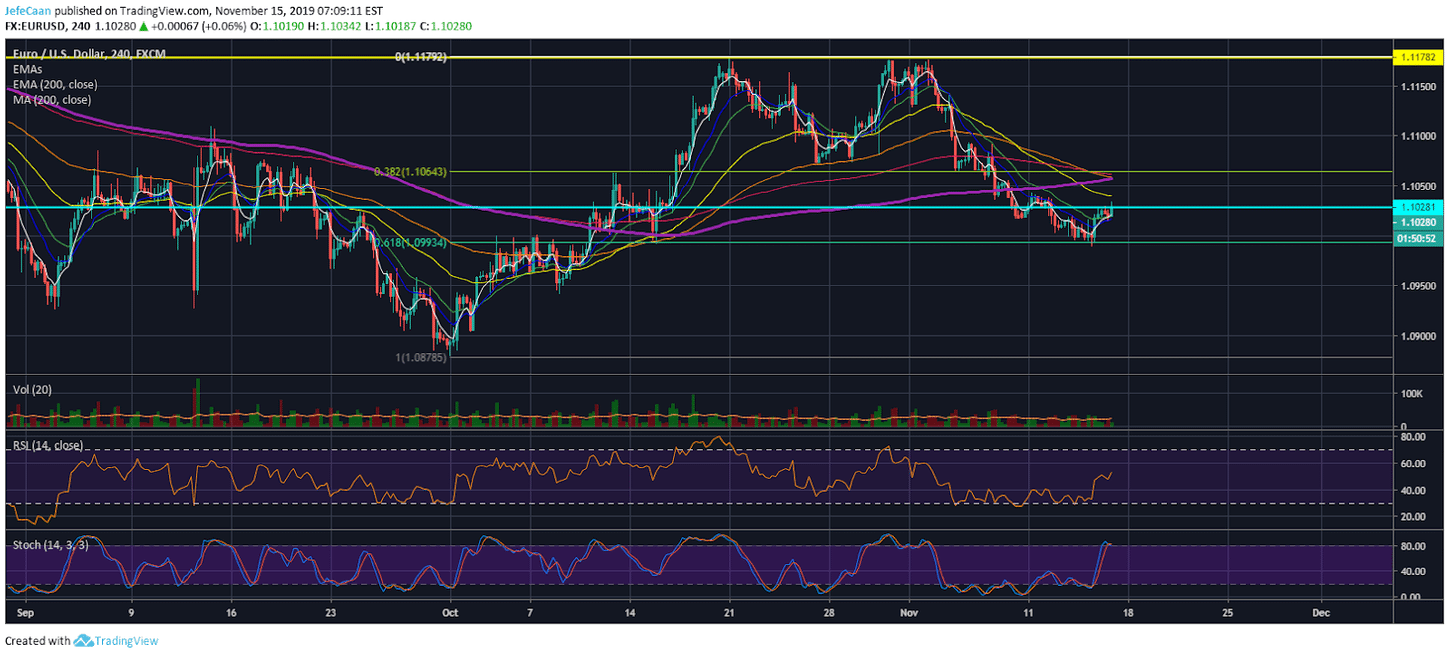

The next direction BTC/USD takes will largely depend on movement in the EUR/USD forex pair. If we see the Euro rally higher, we can expect BTC/USD to follow suit. If EUR/USD declines below the 61.8% fib extension level instead, then Bitcoin (BTC) would be expected to do the same. The 4H chart for BTC/USD shows that we have yet to see a close below the 61.8% fib extension level. Before that happens, we have no reason to be bearish. That being said, until the price closes above the 200 MA, we have no reason to be bullish either. So the price remains in an indecisive phase and we are likely to see it take a definitive direction this week. The weekly close will be important as well but the price is likely to make a big move before that.

The EUR/USD forex pair has reached overbought conditions on the 4H time frame as indicated by the Stochastic RSI. It found support on the 61.8% fib extension level but it is now caught between rock and a hard place. If it breaks out to the upside we could see a retest of the 38.2% and eventually a potential break out past that. However, if it breaks to the downside, then we are looking at the bullish gartley pattern on the 4H chart coming to fruition.

So far, the odds of the pair declining below the 61.8% outweigh the odds of the pair breaking above the 38.2%. That being said, we could see the pair trade sideways between the two levels for a while during which time Bitcoin (BTC) may make its own moves. However, if the EUR/USD forex pair were to make a decisive move in a particular direction then it would be very difficult for BTC/USD to defy it because this pair has a strong pull on the price of Bitcoin (BTC). If EUR/USD rallies, the US Dollar will lose strength which means the price of Bitcoin (BTC) can rise in dollar terms. However, if the opposite happens, the US Dollar will gain strength and that means trouble for Bitcoin (BTC) as its price will decline in dollar terms and end up breaking a key support to decline below $8,543.

Investment Disclaimer