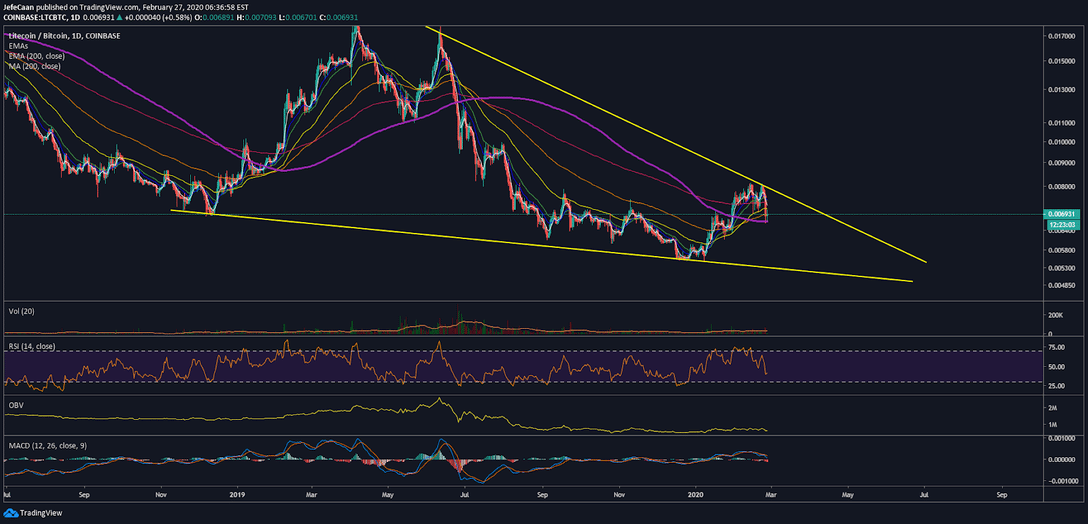

Litecoin (LTC) declined below the 61.8% fib level around $61.28 and closed below it yesterday. Since then it has been attempting to break past this level but it has failed. There is a reason why this level is so important and why LTC/USD is struggling so hard to break past it. If the price finds support here, it would be deemed as the launching pad for the next potential uptrend from here. However, if the price fails to hold this level and declines and closes below the 200-day moving average, it would be considered as the beginning of the next major downtrend that could pull the price even lower than the 2019 low.

So, Litecoin (LTC) is essentially in a do or die situation and we are now waiting to see which way it could swing. So far, the probability of it declining below the 200-day moving average remains quite high. There have been times when LTC/USD has been a good leading indicator for Bitcoin (BTC) and the rest of the cryptocurrency market. This might be one of those times again. So, if LTC/USD declines below the 200-day moving average, we can expect that Bitcoin (BTC) might end up doing the same. Litecoin (LTC) would actually fall a lot harder as it is an altcoin, one that is rapidly losing its use case as Bitcoin (BTC) gets more and more upgrades. There may come a time when Litecoin (LTC) will no longer be as much of a cheaper and faster alternative to Bitcoin (BTC).

This is no different than the dot com boom. A lot of people knew that there was potential just as we see potential in blockchain technology. However, it is hard to pick the winners. In the case of Litecoin (LTC), I think that decision should be pretty simple based on the simple explanation that if Bitcoin (BTC) becomes faster and cheaper with upgrades like the Lightning, then what use case does Litecoin (LTC) have? It will no longer be an alternative, not that it is considered to be one now but when this space gets more mature, a lot of the spin off coins or useless tokens would become the Myspace and Pets.com of the crypto market.

The daily chart for LTC/BTC shows that this many not be a good time to expect a breakout in Litecoin (LTC). Considering that the pair faced a clear rejection at the top of the falling wedge, we can expect a decline down to the 200-day moving average and potentially lower. I would not be surprised if the pair declines to the bottom of the wedge. Litecoin (LTC) may see another rally against Bitcoin (BTC) this year once it finds a temporary bottom within the wedge, but it is extremely unlikely to reach a new all-time high any time soon, if ever.

Investment Disclaimer