Over the past couple of weeks, the markets have been strangely calmed for what we are used to seeing in crypto. Although, there are some outliers like the DeFi tokens run last week or some altcoins that have obtained impressive gains lately. In general, for the past month, main cryptocurrencies like Bitcoin and Ethereum have been experiencing light spot trading levels within a tight range of prices as volatility continues to decline. Multiple issues have been identified by analysts and traders trying to explain this sudden decline in activity. It can be associated with renewed COVID fears or mounting trade tensions but we are unable to know for sure. Numerous articles, interviews, and podcasts are already addressing this topic with different points of view.

For today’s article, the idea is to pass through the macroeconomic environment and its relatively slow trading activity and go deeper into the analysis of Cardano as the upcoming challenger in the blockchain protocols space. The intention is to better understand their performance and status from a data perspective using Intotheblock’s intelligence platform and evaluate what the numbers are actually telling.

Big expectations on Cardano's upgrade.

Cardano is a proof-of-stake blockchain network that has a dual-layer solution, with a unit of account and a control layer that governs the use of smart contracts, recognizes identity, and maintains a degree of separation from the currency it supports. They stand out among other blockchain projects for exclusively using academically peer-reviewed open-source code to provide a smooth-running network that programmers and developers can build applications on.

Cardano has performed impressively well during the first half of the year with a YTD return of 201%. At the time of writing, ADA token is trading at $0.099092 USD with a market capitalization of $2,569 Billion dollars and a steady trading volume that has consolidated well in the top 10 ranking of most important cryptocurrencies after Bitcoin. ADA has now raced up to fresh yearly highs a price we haven't seen since June of 2019, surging more than 10% in just a couple of hours.

The impressive price rally is likely due to optimism ahead of the much-anticipated release of the Shelly upgrade. On June 30, Cardano released the "Shelley Code", as previously announced on their roadmap. The process should be fully completed in about 3 weeks after which the network will undergo a hard fork. It basically consists of an incentivized testnet to reward the holders for delegating their Stake. This promotes the staking of the users inside the network as they become eligible to earn rewards that then will be transferred to one of the Cardano wallets, known as Daedalus and Yoroi.

In terms of price activity, Cardano’s token is one of the few that has managed to appreciate during the last week. It is interesting to see how ADA moves aggressively apart from Bitcoin reaching a 30-Day Low correlation point of (0.1) on July 3rd while its volatility remains somehow steady.

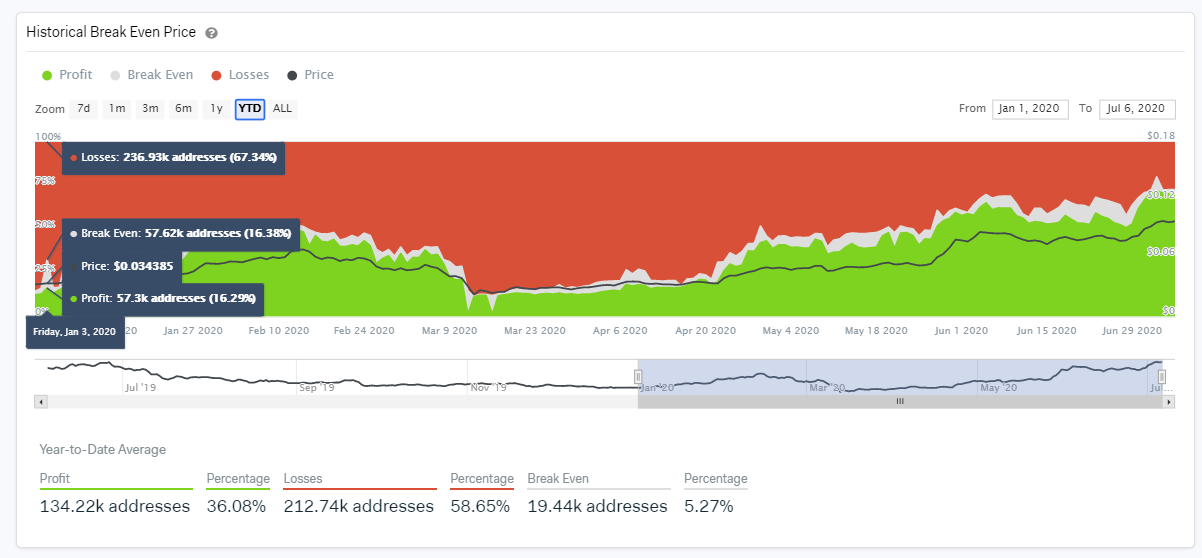

Cardano Holders must certainly be happy by the recent price surge. There are signs of strong recovery for ADA holders as almost 70% of them are In The Money right now. IntoTheBlocks’s In-Out of the Money indicator reveals a holistic view of how this asset is doing in two different perspectives, by addresses, and by volume. As the price went from $0.033 USD in early January towards $0.099 USD as of today, we can see how an important number of holders started recovering and making money on their investment. At the beginning of the year, almost 85% of ADA holders were underwater. An incredible way to change things in just half a year!

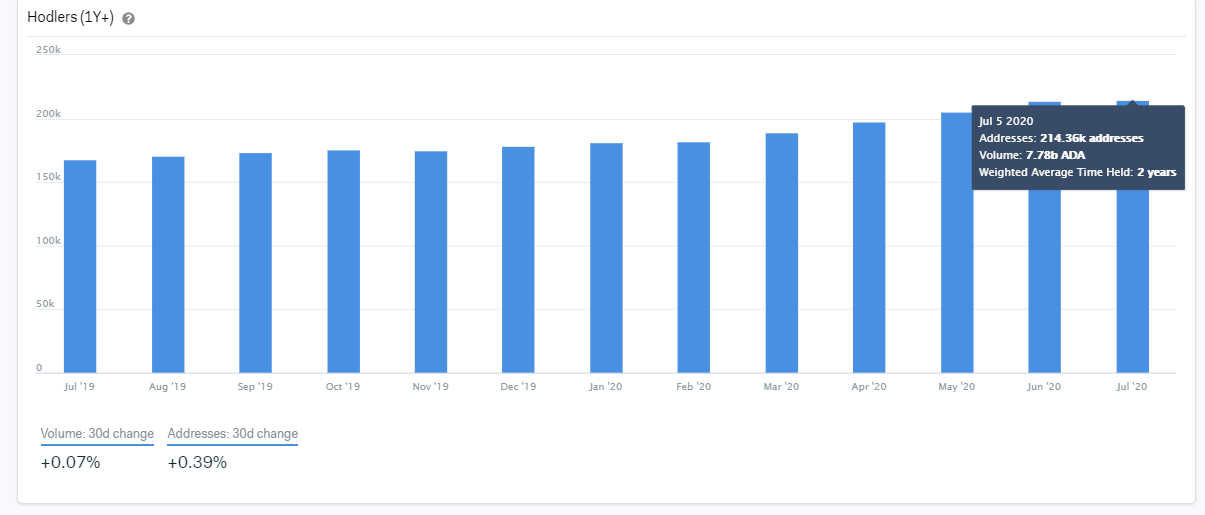

ADA token holders are keeping their investment for a longer period of time. We can see how the number of holders are consistently increasing every month. Last week, the number of addresses reached 213.95 thousand with a volume of 7.78 billion ADA. The average time that tokens are held by these addresses is 2 years.

Finally, in terms of adoption and traction, we can see a spike in the number the Total Addresses of ADA with a positive Balance. This is another metric that has increased considerably during the past couple of months as we can see in the image below.

As the Cardano team aims to become a key player in the emerging supply chain and DeFi sectors, we must be aware of the results of the much-anticipated network upgrade and see how they position themselves for the near future, but their prospects and recent state seems very positive. From the standpoint of IntoTheBlock, our intention is to provide valuable data points that show different views and perspectives to make better-informed investment decisions.

Investment Disclaimer