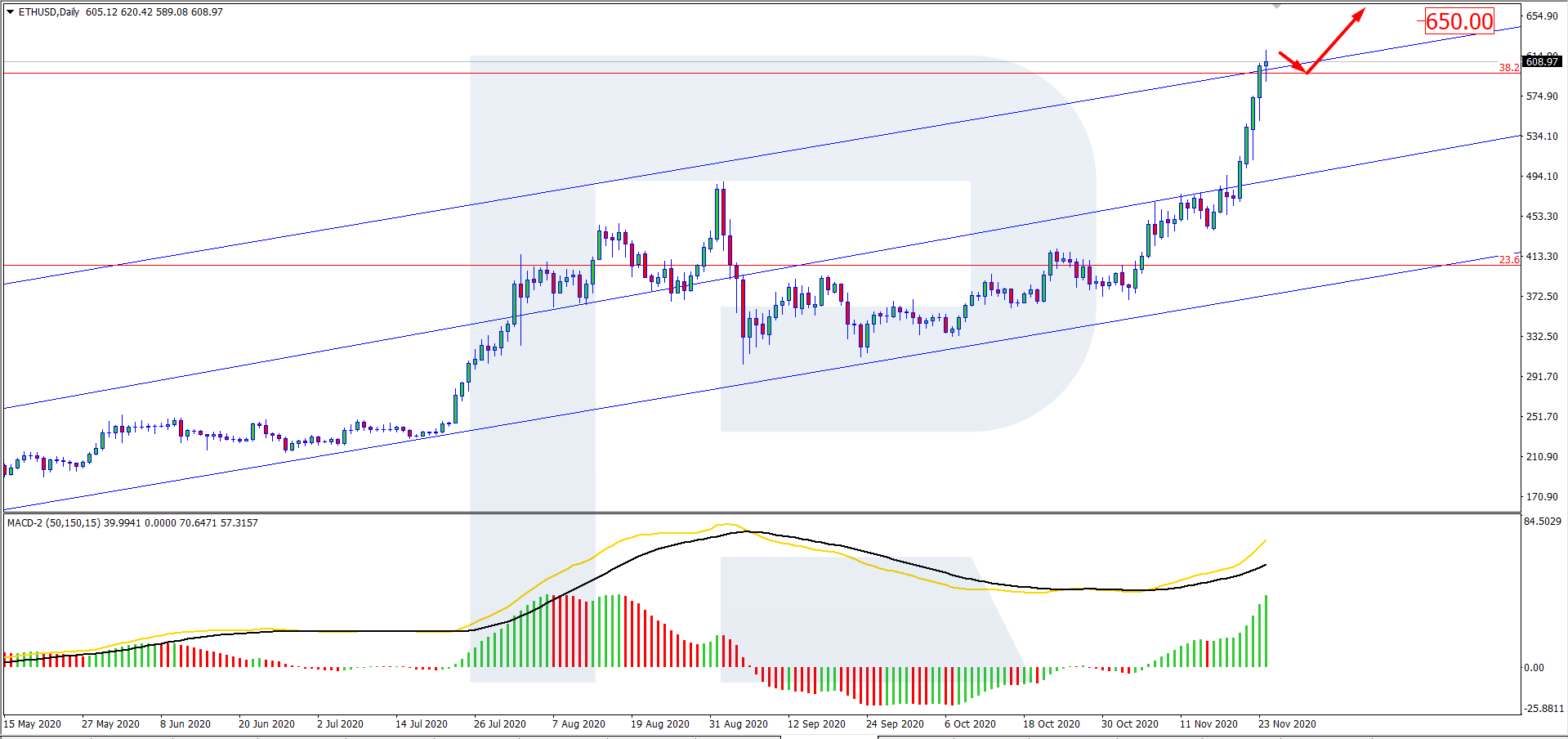

On Tuesday, November 24th, the ETH renewed its highs of 621.40 USD and retreated to 609.00 USD. In the crypto sector, there is still a rally, and the ETH is not standing aside.

On D1, the ETH/USD pair has broken through the upper border of the ascending channel. We may expect the quotations to perform a minor correction and a test of 38.2% Fibo, and then go on rising to 650.00 USD. The MACD histogram remains above zero, giving an additional signal of further growth to the goal on the nearest resistance level – 650.00 USD.

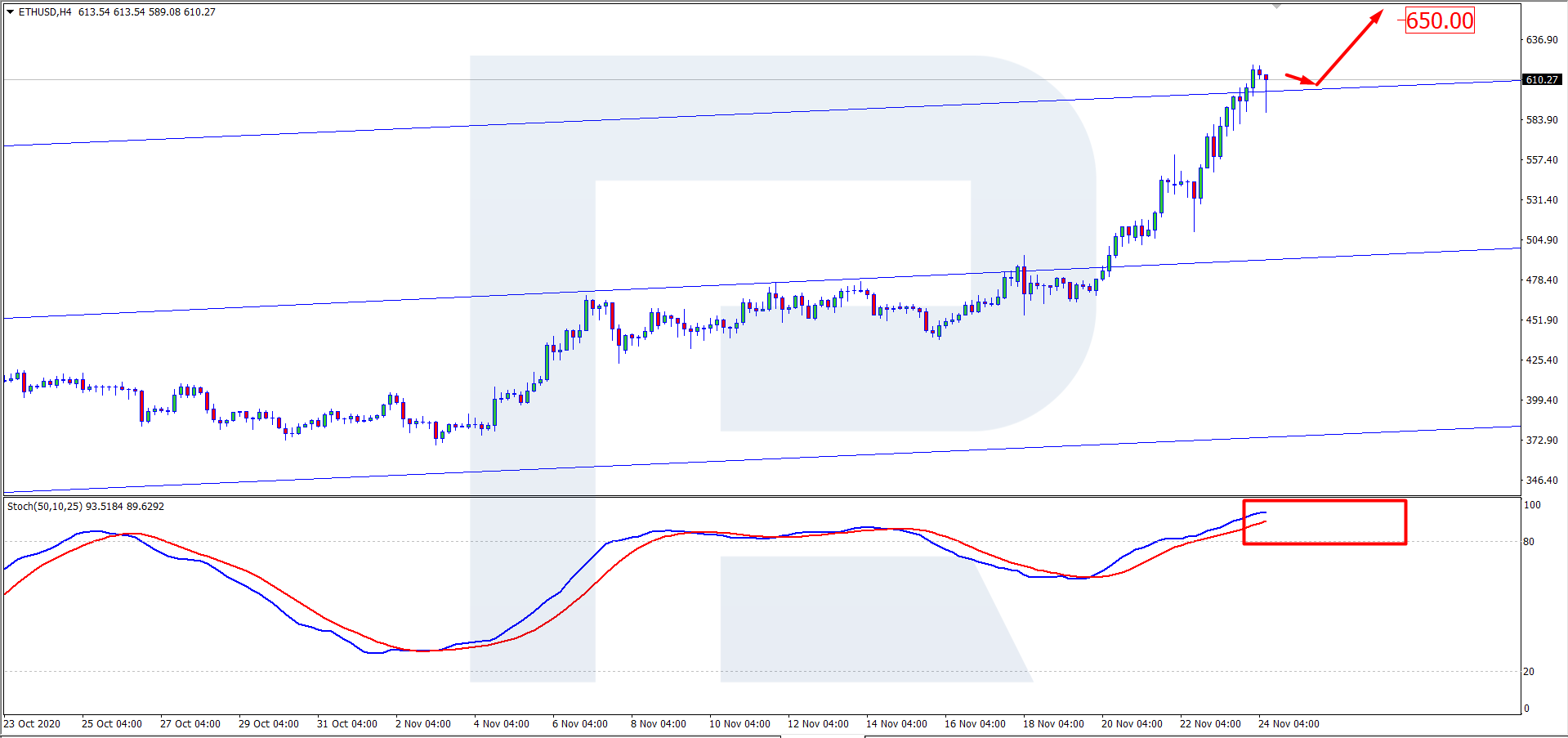

On H4, the picture is similar to that on D1: the quotations have broken through the upper border of the ascending channel. After a minor correction, the coin has all chances for further development of the uptrend. The Stochastic rests in the overbought area, and if a Black Cross forms there, this will give another support to the correction before further growth with the same aim as on D1 – 650.00 USD.

An investment company IBC Group (Dubai) bought about 200 thousand USD, after which they went to the depository contract of the Ethereum 2.0 network. Such an investment might be good for the future of the company: when the network is launched, the number of coins will increase passively by storage on the contract, i.e. stacking.

The company is very positive about the technologies that are to be introduced in Ethereum 2.0. Apart from stacking, the second version must be faster – the speed of transactions will increase noticeably. IBC Group plans that the coins will remain in place until the network switches fully to Ethereum 2.0.

Until December 1st, there must be at least 524,300 coins on the depository contract of Ethereum 2.0 for the company to launch the zero version of the network. Otherwise, the start will be put off for a week.

On Tuesday, November 24th, the ETH renewed its highs of 621.40 USD and retreated to 609.00 USD. In the crypto sector, there is still a rally, and the ETH is not standing aside.

On D1, the ETH/USD pair has broken through the upper border of the ascending channel. We may expect the quotations to perform a minor correction and a test of 38.2% Fibo, and then go on rising to 650.00 USD. The MACD histogram remains above zero, giving an additional signal of further growth to the goal on the nearest resistance level – 650.00 USD.

On H4, the picture is similar to that on D1: the quotations have broken through the upper border of the ascending channel. After a minor correction, the coin has all chances for further development of the uptrend. The Stochastic rests in the overbought area, and if a Black Cross forms there, this will give another support to the correction before further growth with the same aim as on D1 – 650.00 USD.

An investment company IBC Group (Dubai) bought about 200 thousand USD, after which they went to the depository contract of the Ethereum 2.0 network. Such an investment might be good for the future of the company: when the network is launched, the number of coins will increase passively by storage on the contract, i.e. stacking.

The company is very positive about the technologies that are to be introduced in Ethereum 2.0. Apart from stacking, the second version must be faster – the speed of transactions will increase noticeably. IBC Group plans that the coins will remain in place until the network switches fully to Ethereum 2.0.

Until December 1st, there must be at least 524,300 coins on the depository contract of Ethereum 2.0 for the company to launch the zero version of the network. Otherwise, the start will be put off for a week.