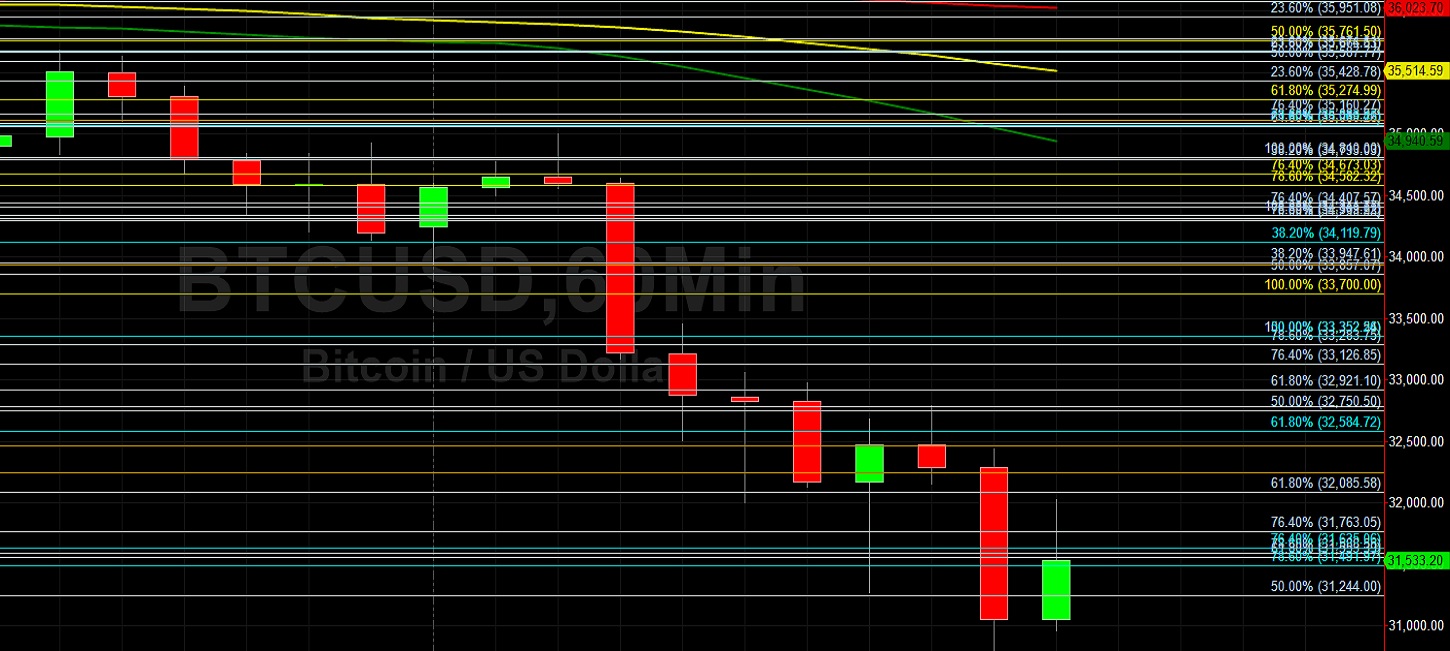

Bitcoin (BTC/USD) extended recent losses early in today’s North American session as the pair weakened to the 30800 area after trading as high as the 35679.45 area during the Asian session, a test of the 23.6% retracement of the depreciating range from 40127.66 to 34298.83, and the 61.8% retracement of the appreciating range from 34341.77 to 37810. Traders took BTC/USD back higher to the 34998.11 level in a rebound during the European session, a test of the psychologically-important 35000 figure, before more selling pressure saw Stops elected below the 33850.03, 33283.75, 32988.07, 32663.13, 32085.58, 31950.11, 31414.00, and 31244.00 levels. As expected, significant Stops were elected below the 33850.03 level, an area around the 38.2% retracement of the appreciating range from 27678 to 37823 and the 61.8% retracement of the appreciating range from 30100 to 40127.66. Large Stops were also triggered below the 32779.10 level, a downside retracement level related to the broader depreciating range from 41452.12 to 30100.

Following this ongoing depreciation, additional areas of potential technical support include the 29783.19, 29093.19, 28847.31, 28148.19, and 27421.33 levels. During the recent move higher, Stops were recently elected above a series of additional upside price objectives, including the 40517.80, 40667.76, 40991.44, 41200, 41267.10, and 41489.74 levels. Stops were recently elected above the 35943.73, 36480.83, and 36854.45 areas as well, upside price objectives related to previous buying pressure around the 17580, 16200, and 9819.83 levels and the sell-off intensified below these areas during the recent depreciation. If BTC/USD is able to extend recent gains to the upside, additional upside price objectives include the 42309.01, 42701.91, 42803.53, 43447.48, and 43617.07 levels. Traders are observing that the 50-bar MA (4-hourly) is bearishly indicating below the 100-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bearishly indicating below the 100-bar MA (hourly) and below the 200-bar MA (hourly).

Price activity is nearest the 200-bar MA (4-hourly) at 31282.06 and the 50-bar MA (Hourly) at 34944.77.

Technical Support is expected around 29783.19/ 29093.19/ 28847.31 with Stops expected below.

Technical Resistance is expected around 42309.01/ 42701.91/ 42803.53 with Stops expected above.

On 4-Hourly chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

Disclaimer: This trading analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Investment Disclaimer