The last three months have been very intense for cryptocurrencies. On February 16, bitcoin revamped its all-time high and surpassed the $50,000 level which sceptics thought unachievable. On the night of February 23, bitcoin lost almost $10,000 to its value but now it is traded at a level of around $50,000. Recently, Tesla invested in bitcoin $1.5 billion. Also, a financial giant Morgan Stanley with $150 billion in assets under management is exploring this option. Twitter CEO Jack Dorsey and rapper Jay-Z pledged $23.6 million toward a trust to fund crypto development.

The last high-profile investment was executed on the evening of February 12 by MicroStrategy. According to experts, this news has become a trigger for the new bitcoin’s all-time high. MicroStrategy, a company that provides business analytics, cloud-based services and mobile software, bet around $600 million on cryptocurrencies. The rumours followed that a company plans to bring another $300 to purchase more bitcoin. Payment giants VISA and Mastercard have announced in unison their plans to develop technologies that would allow their clients to operate with cryptocurrencies.

This news on crypto developments raises a question: how important cryptocurrencies became at a global scale amidst their rocketing growth and recent developments? What stays in the way to crypto mass adoption and what could drive it?

Is mass adoption near?

The discussions over a fully-fledged mass adoption at a global scale are still premature. Cryptocurrency is still too complex to understand for everyone. Yes, several universities are already offering blockchain courses that share knowledge on the technology use cases and value and explain how to use it. But in developed countries, the interest in cryptocurrencies is still spread among the educated minority – big-city residents frequenting tech or investment circles. For the majority, cryptocurrencies remain a strange form of money suitable for illegal purchases on the darknet or speculations.

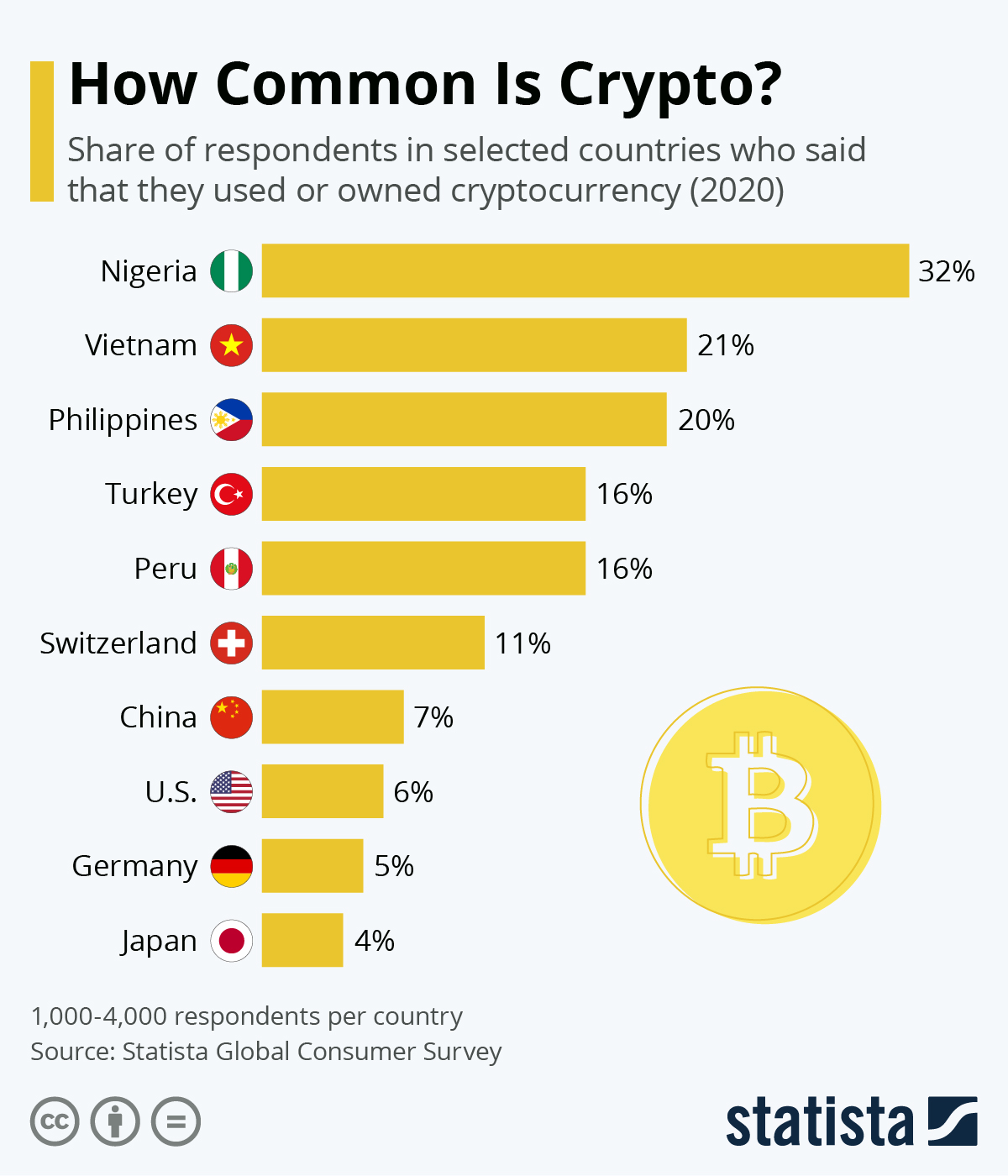

The complexity of cryptocurrencies is not an unbreakable barrier to mass adoption since it was surpassed in developing countries where сryptocurrencies got wider adoption percentage-wise. In those countries, cryptocurrencies solve vital tasks: it protects money from inflation, gives opportunities to conduct business or pursue studies. Even lower levels of financial literacy, in comparison with the US and Europe, do not stand in the way of using crypto. It can be concluded that the main causes of the low level of crypto adoption in developed countries are informational barriers and misinformation.

Who would want to spread misinformation about cryptocurrencies? Here we come to the second cause of the low mass adoption – regulations. First and foremost, favourable legislation influences how institutional investors see cryptocurrencies. While regular users already see value in cryptocurrencies and celebrate their advantages, big investment funds or companies are intimidated by regulative vacuum, frequent variability of the law and its ambiguity.

Why would governments militate against crypto adoption? Let’s not forget that a classic cryptocurrency like BTC, ETH, XRP is a decentralized form of money, the emission or circulation of which can not be controlled by the government. Today, countries are divided into two camps. The first camp understands that cryptocurrencies are the next evolutionary step of the investment market, and later of the payment systems in general, hence there is no need to fight against it. The second camp fears to welcome this uncontrollable phenomenon into the local economy and imposes prohibitive or restrictive measures.

Let’s explore two examples. In the US, the biggest banks like Bank of New York Mellon execute operations with cryptocurrencies and store them while the crypto-related regulations are focused on financial crime law enforcement or protection against fraud in the crypto field. On the other hand, in China or Russia, the government tries to control or restrain the circulation of cryptocurrencies since, in their opinion, crypto adoption could harm the local economy. Chinese government forbids banks to operate with cryptocurrencies. Russian government issues new laws that force crypto holders to declare digital assets.

The government stance influences the scale and tone of the coverage of crypto-related topics in society. Obviously, one can find all the information on the internet. But to find something, one needs to know what to search for. It is hard to do it when the media coverage is tiny or the government restricts it, as it happens in Russia. While a newscaster in the US dedicates half of the broadcast to the growth of bitcoin or crypto analytics, in Russia cryptocurrencies are only passingly mentioned, for example in relation to the new crypto regulations.

Cryptocurrency as a means of payment

The majority of people are nowhere near the world of investment where cryptocurrencies have long been a profitable instrument for portfolio strengthening. Nevertheless, cryptocurrency was not originally invented for investment purposes. Let’s not forget that cryptocurrency is a currency, hence it can and should be used as a means of payment. Ironically, but only a few know cryptocurrencies from this perspective although many reputable brands are already ready to accept crypto payments. Among such companies, there are Amazon, Tesla, Microsoft, Subway, Canadian KFC and others. In Japan, lots of stores are accepting cryptocurrencies and charge them directly from a crypto wallet.

The problem is that most shops and points of sales that we use daily are still left out. The adoption of crypto as a means of payment is primarily in the interest of the crypto market. Otherwise, cryptocurrencies risk remaining a local phenomenon in many regions. In their turn, crypto holders are not satisfied with the costly process of exchanging crypto to fiat – each exchange has its conditions and fees that neutralizes many of the advantages of using cryptocurrencies. But there is a solution – a crypto card. Сrypto cards are exactly the tools that can become a major step towards mass adoption.

Crypto cards as the shortest way to crypto mass adoption

Crypto card is an alternative to plastic debit card only it allows to pay with cryptocurrencies for everyday purchases. The overwhelming majority of shops have not yet started to accept cryptocurrencies so a crypto card comes to the rescue: when a card holder pays with it, cryptocurrencies are instantly converted to fiat. So far, even among those who hold crypto the longest, only a few obtained a crypto card: the total number of crypto cards all over the world issued by all fintech companies hardly exceeds half a million.

It is a pathetically low number, in comparison with approximately 2 billion credit cards issued by VISA and MasterCard. So for now, a crypto card is sort of an exception even for the crypto world. High commissions and limited geographical coverage contribute to it. Most of the cards work in certain regions with various limitations and special conditions. But with the current rate of crypto development crypto cards have all chances to become a trivial product in the average wallet right next to the photos of the family and traditional bank cards.

By the way, there were times when traditional bank cards seemed like a science-fiction fantasy. At the beginning of the 20th century, the majority of the US residents would have laughed at the idea of bank cards replacing cash and called madmen the first adopters of cards that existed in the form of its paper analogues since the end of the 19th century. Already in the 60s of the 20th century, American Express has been actively issuing plastic bank cards. Of course, the mass adoption took time, around 30 years to be precise. But what are 30 years on a historical scale?

Taking into consideration that the current rate of tech development and its adoption is way higher, it is certain that crypto card adoption will not be long in coming. The popularization of crypto cards will help to solidify a social view that cryptocurrencies are a means of payments to be used daily, instead of being just an investment asset or a way to store funds.

More about crypto cards

The crypto cards market offers a variety of options. Some cryptocurrency platforms not only allow users to open accounts or execute operations with crypto but issue crypto cards. Among such platforms, there are Wirex, BitPay, CryptoPay and Monaco. Each product has its specifics, limits and restrictions: withdrawal limits, maximum deposit, a certain fee per transaction etc.

The emission of most of the crypto cards implies the opening of the account on the associated platform, transferring cryptocurrencies there from a user’s wallet and only then charging up a card balance. The requirement to open a personal account is in fact enforcing users to give up on the decentralization principle. In this sense, such platforms are not that far away from traditional banks that exchange crypto to fiat. It is sort of one of the main reasons why the holders of digital money hesitate to use crypto cards – decentralization is crucial for most crypto holders. Moreover, by transferring money to the account on the platform, the user’s money becomes vulnerable to hackers attacks or the project’s management errors. This is one of the main barriers on the way to mass adoption of crypto cards.

Crypto card by TTM Bank

Crypto cards by TTM Bank differentiates itself from competitors since they do not require to open an account on the platform. It is enough to register, confirm your identity, pay €100 – and you will receive your card by mail. Regardless of your location, the delivery fee is already included and there will be no need to pay more. Your cryptocurrencies stay in your wallet – the wallet that you are used to and the wallet the private key to which is known only by you. When you transfer crypto from your wallet to your card account, it is instantly converted to euro that is stored in the licensed bank. This makes a TTM card a bridge between the traditional financial and crypto markets. The card can be used at any place where VISA is accepted – so practically at any place.

For mass adoption, it is important that a TTM Bank card has a stylish design. We live in the world of fashion and brands. The selfie generation works and executes bank transactions. The security starts from a smart design – personal data is hidden from the front side of the card so it can not be stolen by fraudsters even if they glanced at a card.

As for its features, the TTM Bank сrypto card works with five digital currencies: BTC, ETH, USDT, BNB, and TRX. Soon TTM Bank crypto card holders will be able to exchange cryptocurrencies with each other. To execute a transfer, it will be enough to type in the sum and the full name of the recipient. The monthly service fee is €2. It is as convenient to use a TTM Bank as it is to use a regular bank card. Holders can store up to €5000 on their cards, the daily withdrawal limit is €500, the monthly withdrawal limit is €2500.

Summary

Crypto cards could have helped the financially-reliable majority to see decentralized money as a means of payment and therefore become a driver to crypto mass adoption. So far, most of the platforms that issue crypto cards force users to give up on decentralization. Many users are not satisfied with such an offer. That is why for mass adoption, it is more suitable to consider cards that do not put their clients’ funds at risk. One of such cards is a crypto card by TTM Bank. It stores deposited funds in a licensed bank and does not ask clients to transfer funds to third-party platforms.

Disclaimer: This is a sponsored press release, and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.