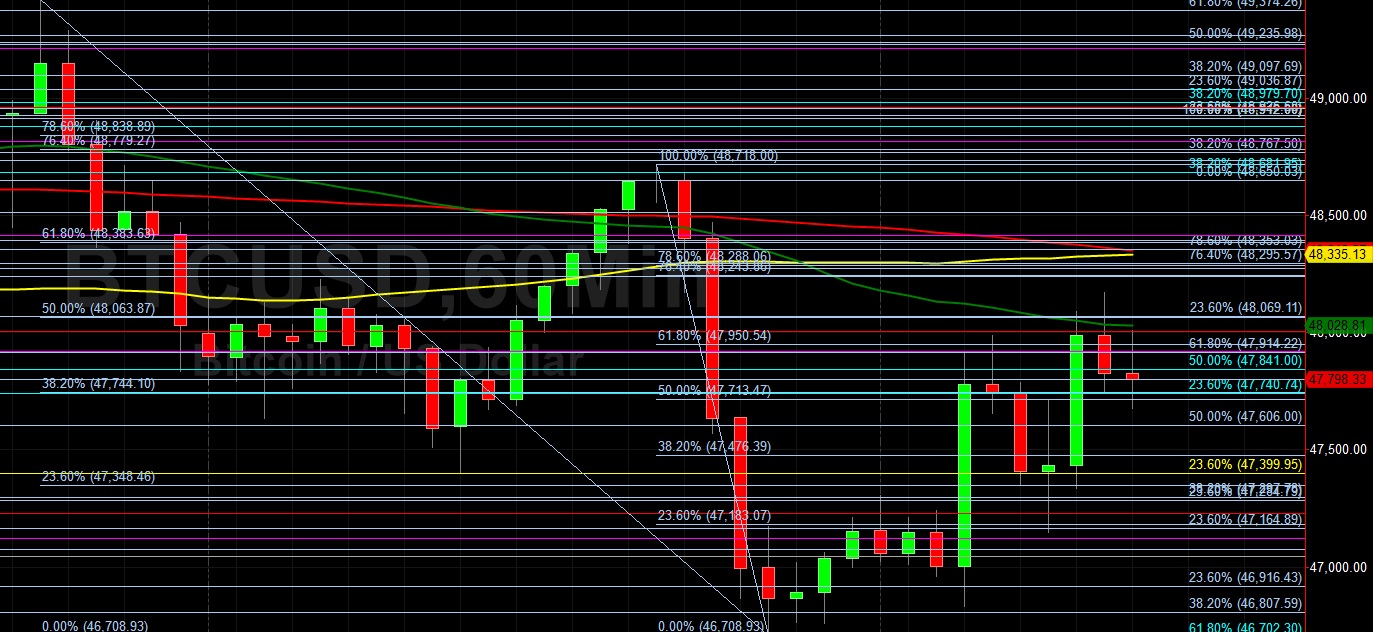

Bitcoin (BTC/USD) protected year-to-date gains early in the Asian session as the pair’s August climb exceeded 13%, pushing the pair’s 2021 gains to more than 62%. After trading above the 49500 area in late August, BTC/USD’s trading activity has included a series of lower highs, an indication that greater profit-taking many ensue. Recent technical failures around the 49418 and 48718 areas have traders focusing on some downside price retracement areas, including the 46457, 45500, and 45356 levels. Stops were elected above the 48813.51 area during the recent ascent, representing the 50% retracement of the recent depreciating range from 50505 to 47122. BTC/USD recently traded as high as the 50505 level, its first trades above the psychologically-important 50000 figure since mid-May.

Traders are paying attention to additional upside price retracement levels including the 51109, 52608, and 53259 areas. Following the pair’s recent advances above the 50000 figure, downside retracement levels and areas of potential technical support include the 47388, 45500, 43902, 42405, 40416, 40125, and 39903 levels. Traders are observing that the 50-bar MA (4-hourly) is bullishly indicating above the 100-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bearishly indicating below the 100-bar MA (hourly) and below the 200-bar MA (hourly).

Price activity is nearest the 100-bar MA (4-hourly) at 47657.94 and the 50-bar MA (Hourly) at 48029.02.

Technical Support is expected around 42405.29/ 39903.28/ 37401.27 with Stops expected below.

Technical Resistance is expected around 50505/ 51569.56/ 64899 with Stops expected above.

On 4-Hourly chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

Disclaimer: This trading analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Investment Disclaimer