Table of Contents

- In Todays Headline TV CryptoDaily News:

- BTC/USD exploded 1.9% in the last session.

- ETH/USD exploded 2.0% in the last session.

- XRP/USD traded sideways in the last session.

- LTC/USD skyrocketed 1.6% in the last session.

- Daily Economic Calendar:

In Todays Headline TV CryptoDaily News:

Coinbase open offshore crypto derivatives exchange

U.S.-based crypto trading firm Coinbase is opening a derivatives exchange in Bermuda as part of an international expansion plan that comes as the publicly traded firm faces regulatory headwinds at home.

Bit Mining launches new generation of rigs

Hong Kong-based crypto mining firm BIT Mining Limited announced the rollout of LD4 – the latest generation of its Dogecoin and Litecoin mining machine. This is the third ASIC mining machine BTCM developed since it acquired the mining hardware maker Bee Computing in 2022.

PEPE token soars to $500M market cap.

PEPE, the token that sprouted out of the "pepe the frog" meme, has rocketed to a $502 million market cap following a 2,100% rise since it was issued last month.

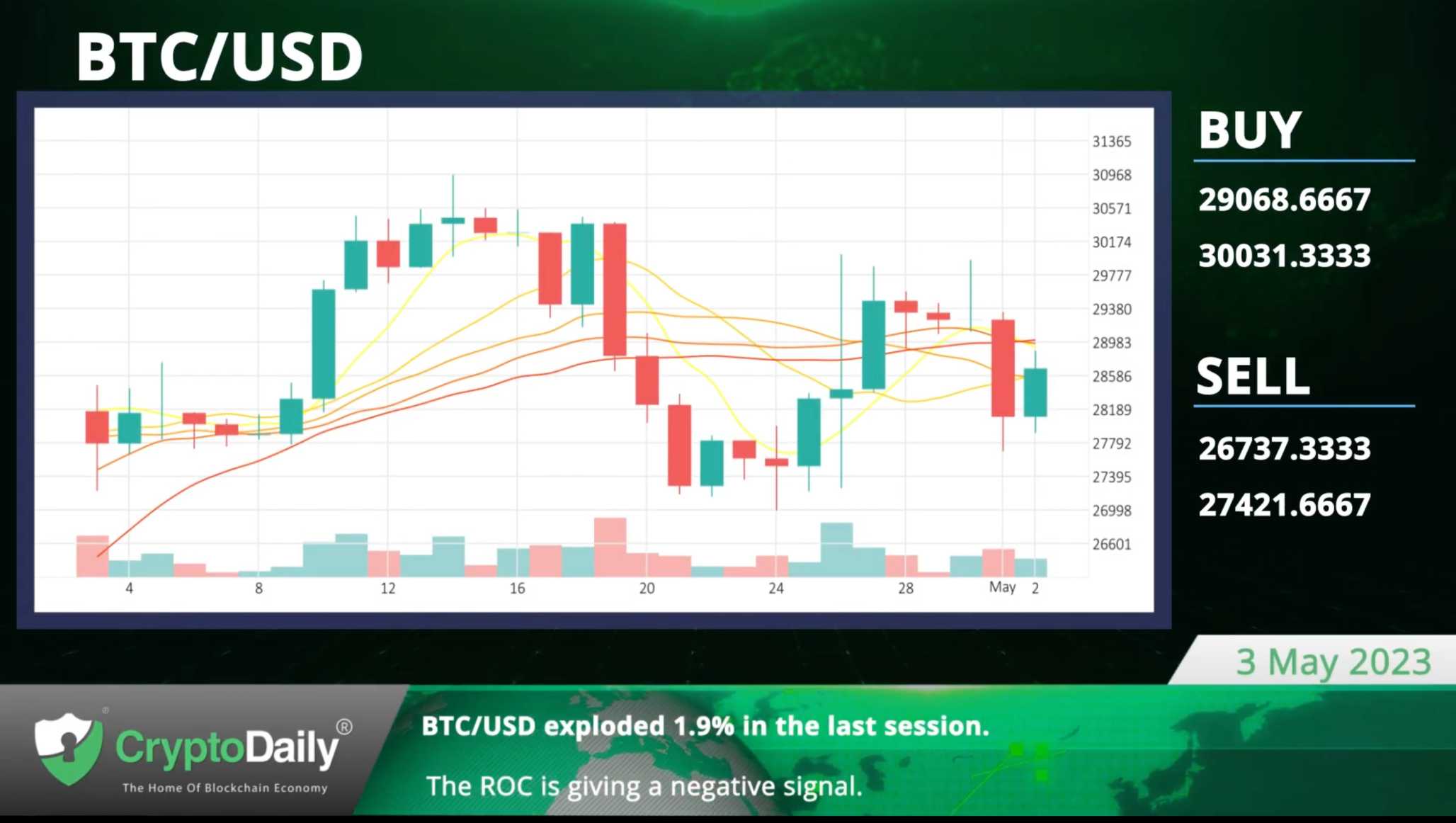

BTC/USD exploded 1.9% in the last session.

The Bitcoin-Dollar pair gained 1.9% in the last session after rising as much as 2.7% during the session. The ROC is giving a negative signal. Support is at 26737.3333 and resistance at 30031.3333.

The ROC is giving a negative signal.

ETH/USD exploded 2.0% in the last session.

The Ethereum-Dollar pair skyrocketed 2.0% in the last session. The Ultimate Oscillator is giving a negative signal. Support is at 1762.8633 and resistance at 1919.6033.

The Ultimate Oscillator is currently in negative territory.

XRP/USD traded sideways in the last session.

Ripple-Dollar price remained largely unchanged in the last session. The Williams indicator is giving a positive signal. Support is at 0.4472 and resistance at 0.4812.

The Williams indicator is currently in positive territory.

LTC/USD skyrocketed 1.6% in the last session.

The Litecoin-Dollar pair skyrocketed 1.6% in the last session. The Stochastic-RSI is giving a positive signal. Support is at 83.3067 and resistance at 90.5867.

The Stochastic-RSI is currently in the positive zone.

Daily Economic Calendar:

US ADP Employment Change

The ADP Employment Change measures the change in the number of employed people in the US, making it an indicator of the labour market. The US ADP Employment Change will be released at 12:15 GMT, the US ISM Services PMI at 14:00 GMT, and the US Fed Interest Rate Decision at 18:00 GMT.

US ISM Services PMI

The ISM Services PMI shows the business conditions outside of the manufacturing sector, taking into account expectations for future production, new orders, inventories, employment and deliveries.

US Fed Interest Rate Decision

The Fed Interest Rate Decision is announced by the Federal Reserve. The interest rates are a key mechanism through which the central bank influences inflation.

US Fed's Monetary Policy Statement

Following the Fed's rate decision, the FOMC releases a statement regarding its monetary policy. The US Fed's Monetary Policy Statement will be released at 18:00 GMT, Australia's Retail Sales at 01:30 GMT, the US Initial Jobless Claims at 12:30 GMT.

AU Retail Sales

The Retail Sales measure the total receipts of retail stores. Monthly percent changes reflect the rate of change of such sales.

US Initial Jobless Claims

The Initial Jobless Claims measures the number of people filing first-time claims for state unemployment insurance.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Investment Disclaimer