Table of Contents

Image source: Gavin Wood - Polkadot, Co-Founder - OuiShare Fest 2016

On September 14, the Solana network witnessed an outage that took it offline for 17 hours. It was a major setback for the high-speed blockchain that has seen rapid growth in recent months, catapulting Solana into the top ten crypto projects by market cap. However, no funds were lost and the network returned to full functionality in under 24 hours.

Following the outage, Polkadot co-founder Gavin Wood took to Twitter to stress the importance of the decentralization and security models deployed in crypto networks, saying: “Events of today in crypto just go to show that genuine decentralization and well-designed security make a far more valuable proposition than some big tps numbers coming from an exclusive and closed set of servers. If you can't run a full-node yourself then it's just another bank.”

According to a post-mortem by the Solana Foundation, the cause of the network stall was effectively a denial of service attack, stating in its blog post: “At 12:00 UTC, Grape Protocol launched its IDO on Raydium, and bots generated transactions which flooded the network. These transactions created a memory overflow, which caused many validators to crash forcing the network to slow down and eventually stall. The network went offline when the validator network could not come to agreement on the current state of the blockchain, which prevented the network from confirming new blocks.”

Polkadot’s Unique Approach

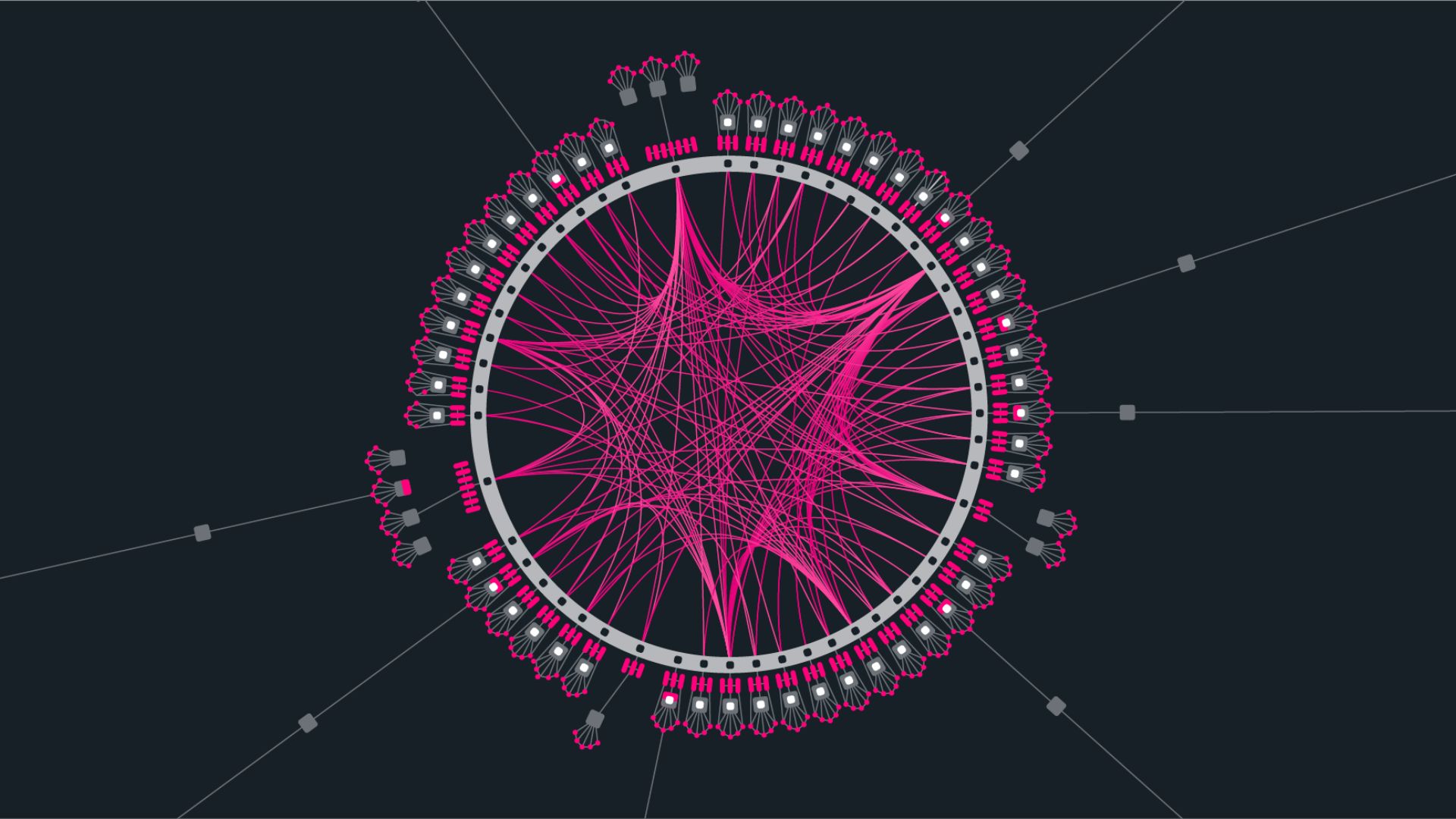

Polkadot has taken the approach of a phased roll-out, with important milestones toward decentralization marking each phase. The multi-chain network uses a decentralized Nominated Proof-of-Stake consensus model, enabling greater participation and allowing nodes to join the network with much lower hardware requirements than the hungry processors of high TPS blockchains like Solana.

Polkadot’s advanced governance model also allows all DOT token holders to control decision-making for the protocol, with upgrades carried out autonomously on-chain to reflect their views.

Polkadot’s shared security model is another unique value proposition for projects considering becoming parachains on its network – the customizable layer-1 blockchains that run in parallel on Polkadots’s sharded infrastructure. The shared security model means that all parachains connected to Polkadot’s central Relay Chain benefit from the economic security provided by its validators.

Parachains “Technologically” Ready for Launch

Responding in a recent interview to when parachains could be launched on Polkadot, Wood suggested that they are “technologically” ready to launch and it was down to the protocol’s governance process to approve them.

With Polkadot’s live canary network Kusama having already successfully launched its first eight parachains, the path is now increasingly clear for parachains on Polkadot too, following this governance process.

“What I can tell you is things are going well on the Kusama side for trying out parachains. The audit, I'm not sure if it's complete yet, but if it's not complete, it's going to be completed in the next few days,” revealed Wood.

“We need to fix any of the issues that come from the audit. As far as I know, these are relatively small issues – nothing huge. And then after that, it's really just up to the governance of Polkadot. I can't flick the switch myself, but what I'm able to do is say, technologically speaking, parachains are ready and it's up to the governance of Polkadot to get them out there.”

The long-awaited parachain rollout seems to be just around the corner, marking the final core launch phase for Polkadot, with successful Kusama parachain slot teams like Acala and Moonbeam among contenders for the maiden slots.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.